Collection Due Process (CDP) - Orange County

If the taxpayers have a CDP (Collection Due Process) hearing, they are able to raise the underlying liability; however, they must do it at the first opportunity. What this means is that the taxpayer must raise the issue of the liability when they are allowed their first CDP (Collection Due Process) hearing, whether that notice is for the threat to levy or the filing of the NFTL (Notice of Federal Tax Liens).

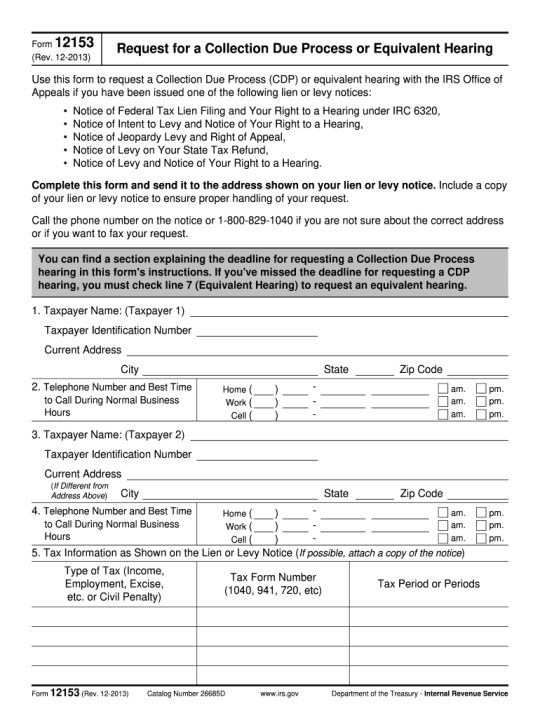

The taxpayers can raise the issue when they file the Form 12153 by checking “Other” at the bottom of Box 8 and writing in the explanation that they don’t believe they owe the money the IRS believes they do. When the taxpayers do hear back from Appeals, they should submit their documentation to the Settlement Officer for consideration and attempt to have the liability reduced